Open a bag of chips, unbox a frozen lasagna, or unwrap your favorite ice cream bar today, and you might…

Unveiling the Hidden Costs: A Comprehensive Look at Retail Practices Affecting Consumers

Introduction to Slotting Allowances and Retail Economics:

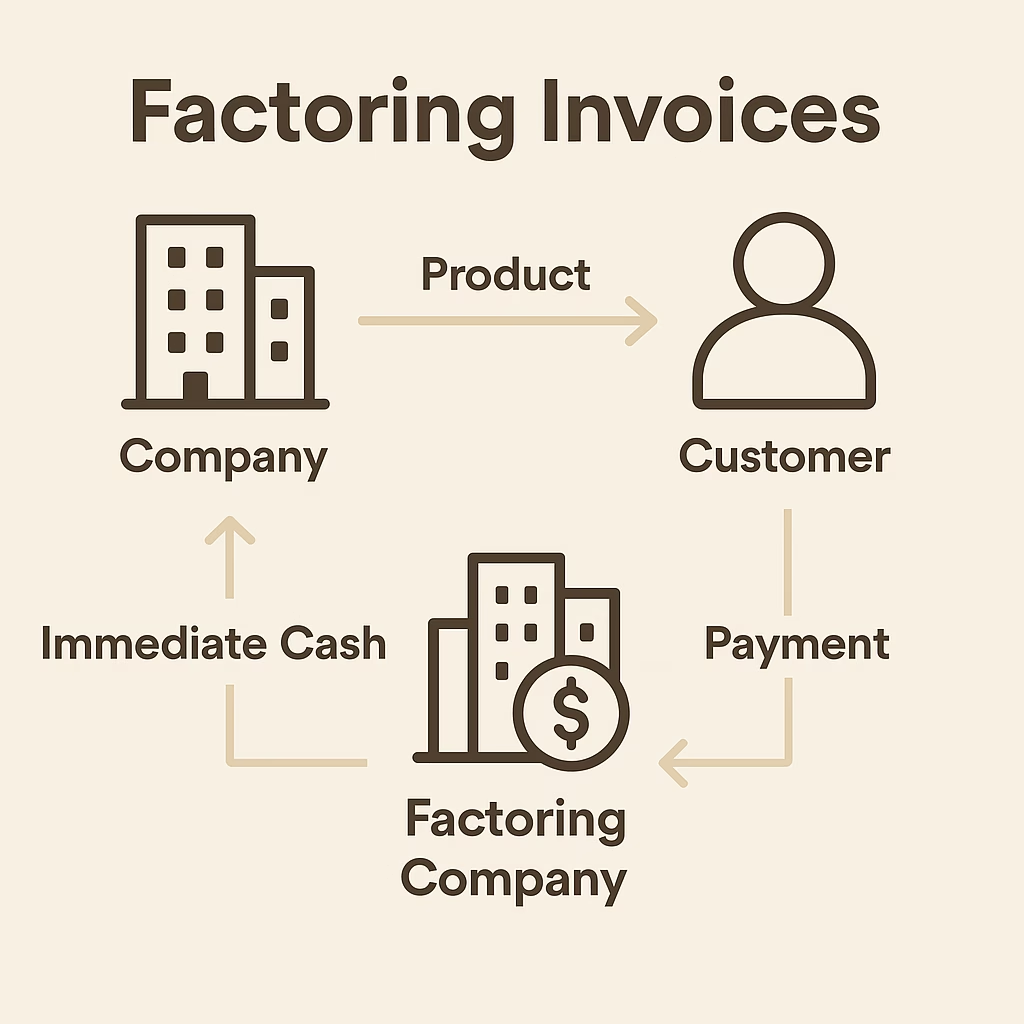

Slotting allowances, known in the retail industry as fees manufacturers pay to retailers for product placement, particularly for new offerings, serve multiple purposes. Retailers assert that these fees help mitigate the risk of dedicating shelf space to unproven products and compensate for the operational costs of stocking and rearranging store shelves. However, these fees often result in higher prices for consumers and can vary significantly, creating barriers to entry for smaller manufacturers who cannot afford the steep costs of shelf placement.

The issue of high executive compensation in the supermarket and convenience store industries is a point of contention, especially when considered alongside practices such as slotting fees. Top executives in these sectors often receive multimillion-dollar compensation packages, which can be a factor in the overall cost structure of the company. While executive pay is typically justified by the need to attract and retain top talent, these high salaries can contribute to a company’s operational costs. As a result, some argue that in an effort to maintain profit margins while covering substantial executive salaries, retailers may be more inclined to impose or increase slotting fees for manufacturers seeking shelf placement for their products.

One example of high executive compensation in the supermarket industry is the CEO of Kroger, Rodney McMullen, who received a total compensation package of $19 million in 2022. This amount marked a 6% increase from his compensation in 2021, which was $18 million. The raise was partly due to an 18% increase in McMullen’s stock awards from the previous year. The median pay for a typical Kroger worker in 2022 also saw a 6% increase, reaching $28,644.

The cost of slotting fees for a new item can vary widely based on a multitude of factors including market, demand, product category, and the retailer’s policies. For example, a new product might incur a fee ranging from a few thousand dollars in a local supermarket to potentially hundreds of thousands or even over a million dollars for a new product’s national rollout in a major chain. These fees represent a significant cost for manufacturers and can have a direct impact on the retail price of the product, which is ultimately borne by consumers.

The relationship between high executive pay and the use of slotting fees is complex. While there is no direct causation, the pressures of financial performance and profitability can lead retailers to rely more heavily on such fees as a revenue source, influencing how and at what price products are presented to consumers in stores.

Ethical and Legal Considerations in Retail Practices

The use of slotting allowances has raised ethical and legal questions concerning their impact on competition and consumer choice. Antitrust concerns suggest that high fees could potentially limit competition by creating barriers for smaller manufacturers. While the Federal Trade Commission (FTC) has not declared slotting allowances inherently anti-competitive, it continues to monitor these practices for potential violations of antitrust laws. Ethically, there’s a call for transparency in retail pricing and product selection to allow consumers to make informed purchasing decisions.

Self-Checkout Systems and Labor Distribution

The implementation of self-checkout systems represents an operational efficiency initiative for retailers but also introduces ethical considerations. The shift of labor from employees to consumers, often without apparent cost savings for the latter, raises questions about the value of labor and the fair distribution of efficiency gains. Moreover, legal concerns regarding consumer privacy and data security arise as these systems handle sensitive personal information, requiring stringent compliance with data protection laws.

Executive Compensation and its Impact on Retail Pricing

The high levels of executive compensation in the retail sector have drawn scrutiny, especially when juxtaposed with price increases for consumers. Legally, executive pay is regulated by corporate governance and shareholder approval, but perceived excessive compensation can lead to demands for reform. Ethically, the disparity between executive compensation and average worker salary prompts discussions on income inequality and the possibility that more equitable pay structures could result in lower consumer costs.

Inflation, Pricing, and Asymmetric Responses

Retailers’ pricing strategies in response to inflation can reflect an asymmetric approach, with prices quickly rising in the face of increased costs but not adjusting downward as readily when costs decrease. This pattern of behavior raises legal concerns over price gouging and ethical questions about fair pricing practices, emphasizing the need for adjustments to be reflective of actual cost changes in alignment with fairness and transparency.

The Correlation Between No Slotting Fees and Consumer Satisfaction

Retail chains that do not charge slotting fees, such as Publix and Wegmans, often enjoy higher consumer satisfaction ratings. This correlation is attributed to their focus on product quality, diversity, and consumer choice over financial arrangements for shelf placement. These retailers offer a wider variety of products, including items from local and smaller manufacturers that might otherwise be unable to afford traditional slotting fees.

Maintaining Traditional Services and Enhancing the Shopping Experience

Unlike many chains that have reduced or eliminated traditional services like complimentary bagging and assistance to vehicles, some retailers continue to prioritize customer service. Publix, for example, is known for its complimentary bagging service and willingness to assist customers to their cars, reflecting a commitment to accessibility and convenience that bolsters its consumer satisfaction ratings and sets it apart in the industry.

Conclusion

Supermarket and convenience store practices, including slotting allowances, self-checkout systems, executive compensation, and responses to inflation, carry a complex array of ethical and legal considerations with direct financial implications for consumers. Ensuring transparency, fairness, and corporate responsibility is vital as the retail landscape evolves. Retailers that prioritize customer relationships and transparency, such as those eschewing slotting fees and maintaining high service levels, exemplify a business model that could lead the industry towards a fairer and more consumer-friendly future.