The functional beverage space is evolving—fast. What started with protein shakes and vitamin waters has transformed into a sophisticated market…

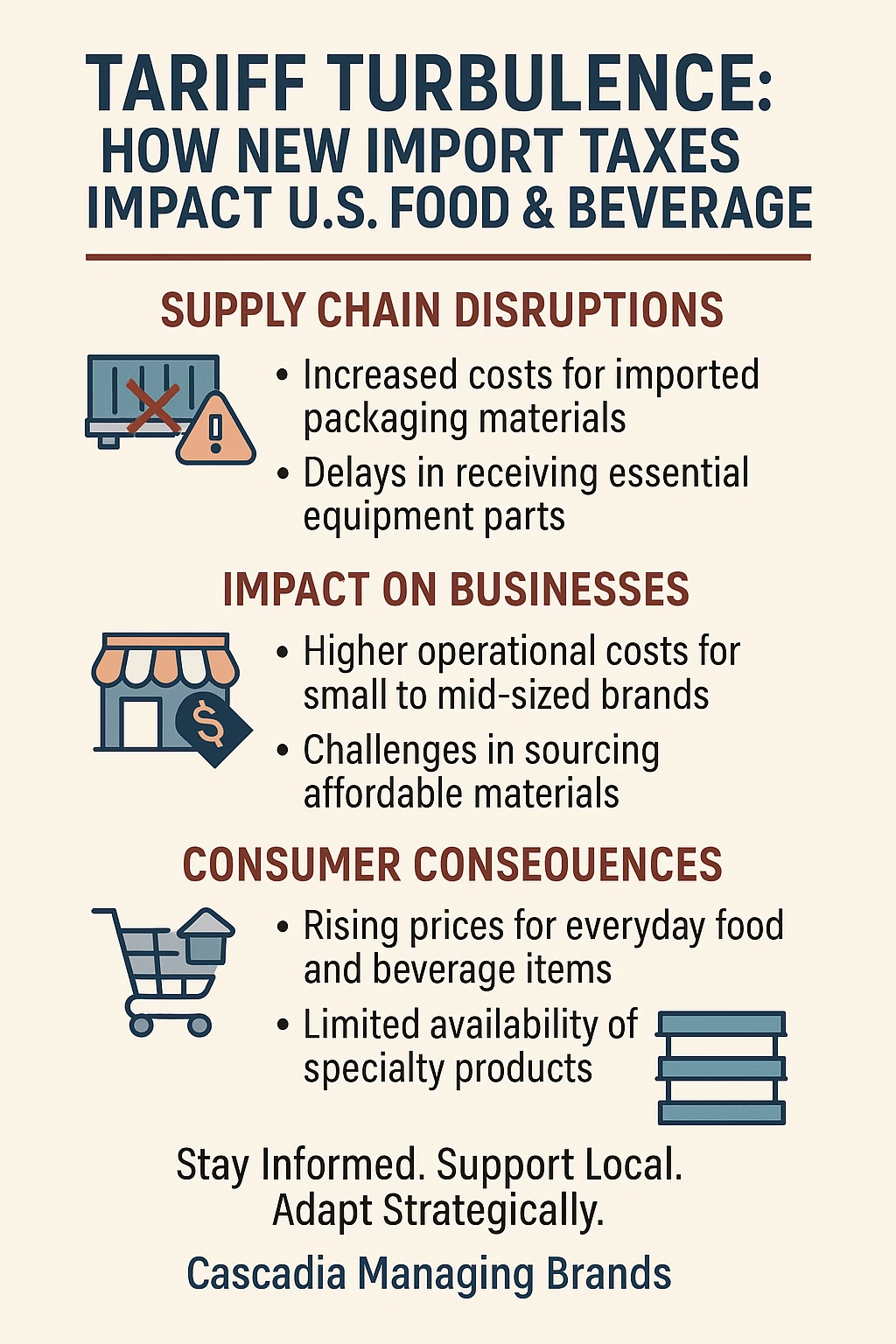

The End of De Minimis: Why a Tariff on Temu and Shein Could Quietly Disrupt the U.S. Food & Beverage Industry

At first glance, today’s headlines about the end of the de minimis exemption—and the 145% tariffs now hitting small Chinese shipments—seem mostly about clothes, toys, and cheap gadgets.

But hidden beneath the noise about fast fashion and home décor lies a potential ticking time bomb for U.S. food and beverage companies.

Here’s why this matters far more than most industry insiders—and certainly most consumers—currently realize.

1️⃣ Packaging Shockwaves: The Supply Chain Domino Effect

Most emerging and mid-sized U.S. food and beverage brands do not produce packaging domestically. Why?

- U.S. packaging production is expensive and requires large MOQs (Minimum Order Quantities)

- Many specialized items (custom caps, unique glass bottles, biodegradable films, holographic shrink sleeves) come from China or Southeast Asia

- Even large U.S. companies buy Chinese molds, dies, and packaging components

Brands—especially startups—routinely source:

| Component | Example |

|---|---|

| Bottle caps | Custom tamper-evident caps |

| Film labels | Specialty shrink sleeves |

| Pouches | Flexible barrier pouches |

| Straws & utensils | Compostable and specialty items |

| Displays | Retail POS stands & case stackers |

Before today:

These items often shipped in small, $300 to $800 batches to avoid duties and storage issues.

Now:

Those same items face 145% tariffs—or more. A $500 shipment could now cost $1,225 or more before shipping.

Impact:

👉 Startups and craft brands will be squeezed out of innovation or forced to increase retail prices.

👉 Mid-size brands will either absorb costs (cutting already tight margins) or pass them along to consumers.

2️⃣ Co-Packer Crunch: Rising Costs and Delays

Many co-packers, even for established brands, source replacement parts, filters, and small run packaging from China under de minimis rules.

Now:

- Parts will cost more and take longer due to customs delays

- Maintenance and repairs may lag, reducing line uptime

- Small brands trying to scale will face bottlenecks or higher MOQ minimums

Consumer impact:

👉 Production delays may lead to more out-of-stocks

👉 New product launches may be postponed or canceled

👉 Rising wholesale costs will hit grocery shelves by late summer or fall 2025

3️⃣ Retail Display & POS Disruption: No More Cheap Merchandising Tools

Many U.S. brands—especially smaller ones—order customized POS materials or retail displays from overseas:

- Corrugated display shippers

- Branded shelving

- Metal racks

- Shelf talkers and wobblers

De minimis allowed test runs and small regional orders without punishing tariffs.

Now:

Small orders for displays or marketing materials will become prohibitively expensive. Domestic options require long lead times and large minimum orders.

Impact:

👉 Brands will reduce or eliminate retail promotions, hurting shelf visibility

👉 Large brands may monopolize endcap and promotional space even more

👉 Independent retailers will see fewer creative displays and merchandising support

4️⃣ Ingredient and Tool Sourcing for DTC Brands

Hundreds of direct-to-consumer food brands, spice companies, specialty oils, and baking kits rely on overseas suppliers for:

- Small-run ingredients (specialty spices, sweeteners, rare teas)

- Kitchen tools included in bundles (spoons, whisks, glass jars)

- Custom inserts or gift packaging

These were often imported in low-cost, under-$800 batches.

Now:

👉 Those items will either stop arriving or become 2x to 3x more expensive

👉 Subscription box prices will rise

👉 Some companies may shut down DTC offers entirely

5️⃣ Lower-Income Shoppers Hit First—And Hard

A CNN article dated May 2, 2025 pointed out that 48% of de minimis shipments went to America’s poorest zip codes.

That includes:

- Kitchen gadgets

- Food prep items

- Baking accessories

- Budget-conscious home cooking tools

Consumers who can’t afford $400 mixers or $30 gadgets at Target turned to Temu and AliExpress.

Now:

👉 These consumers will either pay dramatically more or stop buying altogether

👉 Value grocery channels will feel the pinch as accessory items disappear or double in price

👉 Lower-income consumers may reduce purchases of specialty foods and tools

Long-term risk:

👉 A growing divide between affluent and budget-conscious shoppers in food purchasing behavior

👉 Specialty brands may shift to premium-only markets, leaving fewer choices for value shoppers

6️⃣ The Bigger Threat: Innovation Freeze

This is the most serious—and least discussed—impact.

For over a decade, U.S. food and beverage entrepreneurs have relied on global sourcing flexibility to:

- Test new SKUs

- Order small runs of specialty packaging

- Trial promotional concepts

De minimis allowed them to do this without betting the farm.

Without it:

- Cost of testing rises

- Minimum order quantities become barriers to entry

- Smaller, riskier ideas won’t get to market

Result:

👉 Fewer innovative brands

👉 Slower category evolution

👉 Large brands gain more power as barriers rise for small players

A Hidden Impact That May Surprise Everyone

Expect domestic co-packers and U.S. packaging companies to raise prices. Why?

- Demand will spike as brands scramble for U.S. sources.

- Without Chinese competition, U.S. suppliers regain leverage.

Even brands trying to reshore their sourcing will likely face:

- Higher prices

- Longer lead times

- Stricter order minimums

Conclusion: The Unseen Food & Beverage Fallout

The mainstream media is focused on fashion and electronics. But behind the scenes, the end of de minimis could:

- Push small food and beverage brands out of business

- Slow down the launch of new and innovative products

- Lead to higher prices at the shelf

- Reduce variety and choice for all consumers—especially those in lower-income brackets

This won’t happen overnight. But by late 2025 and into 2026, consumers and retailers will start seeing the cumulative effects.

Pro Tip for Brands:

If your business relies on small imports for packaging, ingredients, or promotional materials, start renegotiating with domestic suppliers now. Prices are about to climb—waiting will only increase your costs and risks.