The functional beverage space is evolving—fast. What started with protein shakes and vitamin waters has transformed into a sophisticated market…

Factoring Invoices: The Lifeline (and Hidden Trap) for Food & Beverage Brands

In the fast-moving consumer goods world, few challenges keep founders awake at night like cash flow gaps.

For food and beverage companies—where making payroll, producing inventory, and paying for raw materials come before getting paid by supermarkets or distributors—the gap between shipment and payment can make or break your business.

That’s why many brands explore invoice factoring. But while it can provide critical funding, it also has risks and trade-offs that every founder must understand.

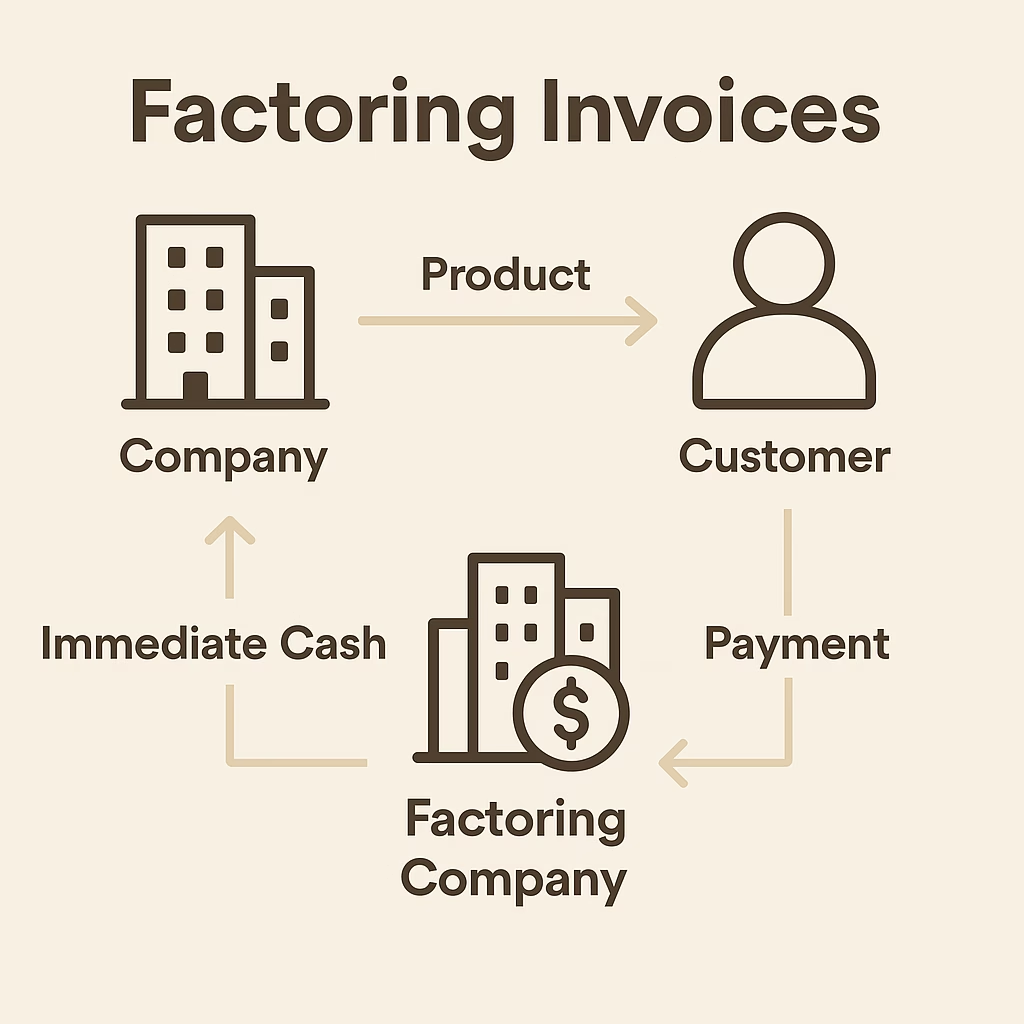

What Is Invoice Factoring—Really?

At its simplest, factoring means selling your invoices (accounts receivable) to a third-party company (a “factor”) for immediate cash. The factor collects payment from your customer later and keeps a fee.

But this simplicity hides layers of complexity:

- Advance rate: Typically 70% to 90% of the invoice amount.

- Reserve: The remaining 10% to 30%, held back until the customer pays.

- Fees: Often 1.5% to 5% per month, not per annum—meaning the effective annualized rate can be as high as 18% to 60%.

- Recourse vs. Non-recourse: Some factoring agreements make you liable if the customer never pays.

Key distinction: Factoring is not a loan. It’s a sale of receivables. That can make it easier to obtain, but also more costly and complicated than traditional debt.

Why Food & Beverage Brands Turn to Factoring

Let’s be honest—most brands don’t want to factor. They turn to it because cash flow problems are common, especially when:

- Big retailers demand long payment terms.

- Kroger, Walmart, Whole Foods, and others may require NET 60 to NET 90.

- Production and shipping are paid upfront.

- Co-packers, ingredient suppliers, packaging vendors, and freight companies expect prompt payment.

- Retailers and distributors take deductions.

- Promotional discounts, damaged goods, freight claims, and “off invoice” allowances mean you almost never receive 100% of your invoice amount.

- Rapid growth.

- Ironically, your business success can create cash shortages. Large purchase orders tie up more working capital.

Factoring can free up cash to produce, promote, and grow without waiting months for customer payments.

The Real Costs: More Than Just Fees

1. Direct Fees

- As noted, factoring fees typically range from 1.5% to 5% monthly.

- If the customer takes 90 days to pay, that could equate to 4.5% to 15% of your invoice value.

2. Hidden Costs

- Credit risk premiums for newer brands or customers with poor credit.

- Processing fees or minimum invoice amounts.

- Annual fees or monthly service charges.

3. Erosion of Margins

- Most food & beverage brands already work on thin gross margins.

- Adding factoring costs can quickly turn profitable orders into break-even or losses.

For example, a beverage brand with a 35% gross margin factoring at 4% for a 60-day term gives up 11% of its gross margin just to get paid early.

4. Customer Relationship Risks

- Retailers may perceive factoring as a sign of financial weakness.

- Some may resist working with brands using factoring, especially if the factor aggressively pursues late payments.

Recourse vs. Non-Recourse Factoring: Critical Distinction

- Recourse factoring: If your customer doesn’t pay, you must repay the factor. This is cheaper but risky.

- Non-recourse factoring: The factor assumes the credit risk. This is safer for you but has higher fees.

Most food & beverage factoring is recourse-based. Why? Because most factors don’t want to take the credit risk on retail or foodservice buyers, despite their size.

When Should You Use Factoring?

Situations where factoring makes sense:

✔ Large, reputable customers with long payment terms. (Whole Foods, Kroger, KeHE, UNFI, etc.)

✔ Rapid growth periods where waiting 90 days for payment could derail momentum.

✔ Bridge financing while you secure longer-term funding.

✔ Seasonal demand spikes when production needs exceed cash reserves.

Important: Only use factoring to solve timing mismatches—not to cover ongoing losses. If your company isn’t profitable before factoring, adding fees will deepen the hole.

When You Should Avoid Factoring

🚫 Low-margin products where fees would wipe out profits.

🚫 Poor customer payment histories—the factor may not accept your invoices.

🚫 Small invoice amounts—factors often require minimum invoice sizes, usually $10,000 or more.

🚫 Long-term dependence—if factoring becomes permanent, you likely have a pricing or cost structure problem.

How to Choose a Factor (and Avoid Predatory Ones)

Not all factoring companies are created equal.

Look for:

- Experience in food & beverage. They’ll understand retailer chargebacks, promotion deductions, and distributor logistics.

- Transparent fee structure. Avoid hidden costs.

- Reasonable contract terms. Watch for long lock-in periods or automatic renewals.

- Reputation. Check references from other CPG brands.

- Flexibility. Some factors allow you to pick which invoices to factor (called “spot factoring”).

Red flags:

- High-pressure sales tactics.

- Personal guarantees required.

- Lack of clarity around customer notifications.

Alternatives to Factoring (That You Should Explore First)

Before resorting to factoring, food & beverage companies should consider:

- Supplier financing or longer payment terms from vendors.

- Negotiating better payment terms with buyers.

- Revolving lines of credit from banks.

- Purchase order financing.

- Equity funding or convertible debt.

Sometimes a mix of strategies, including occasional factoring, is the best approach.

The Bottom Line: A Tool, Not a Strategy

Factoring is a tool to solve temporary cash flow timing gaps. It should not become a long-term funding strategy.

If your company finds itself factoring every invoice month after month, that’s a sign to step back and analyze:

- Are margins too low?

- Are payment terms unsustainable?

- Is pricing aligned with costs?

- Are there other capital sources available?

Many successful food & beverage companies have used factoring at some point—but only as a bridge, not a permanent solution.

Use factoring strategically and sparingly. It should help you grow—not become a crutch.

| Feature | Invoice Factoring | Bank Loans/Lines of Credit | Extended Supplier Terms |

|---|---|---|---|

| Speed of Access | Fast (can fund in days) | Slow (weeks to months for approval) | Immediate if negotiated |

| Approval Criteria | Based on customer creditworthiness | Based on company credit, history, and assets | Based on vendor relationship & history |

| Impact on Ownership | None | None | None |

| Cost/Fees | High (1.5%–5% per month) | Low to moderate (typically 5%–15% annual APR) | Usually no fees; may pay higher unit cost |

| Repayment Obligation | Customer pays factor (recourse or non-recourse) | Borrower repays principal + interest | Repayment of invoice per negotiated terms |

| Collateral Required | No (except in some recourse cases) | Often required (inventory, AR, equipment) | No |

| Effect on Customer Relationship | May affect perception; customers deal with factor | None | None |

| Flexibility | High (select invoices or entire AR) | Medium (fixed credit limits) | Depends on supplier’s willingness |

| Best Use Case | Bridging cash flow gaps due to long customer payment terms | Long-term working capital or growth financing | Managing short-term cash flow, especially during growth or seasonality |

| Risk | Loss of margin due to fees; customer payment issues | Debt burden; possible default | Over-reliance can strain vendor relationships |

Key Takeaways:

- Factoring offers the fastest cash but at the highest cost.

- Bank loans are cheaper but slower and require strong financials or collateral.

- Supplier terms are the lowest-cost option but rely on vendor goodwill and negotiation leverage.