Introduction: What Is a Burning Platform? Most businesses don’t change because they want to. They change because they have to.…

“Do You Have Chain Authorization?” — How Distributors Are Losing Millions by Waiting Too Long to Act

There’s a question emerging brands hear far too often from distributors:

“Do you have chain authorization?”

It’s asked with an air of gatekeeping, as though without a major retail commitment in place, a brand has no business being considered. On the surface, it seems like a logical filter—but in reality, this mindset is killing innovation, limiting revenue, and hurting distributors far more than they realize.

Let’s unpack how this flawed logic plays out—and how much it’s really costing.

🧃 The Premise: “No Chain Authorization? No Interest.”

Distributors, especially in the Direct Store Delivery (DSD) model, love to play it safe. They often refuse to onboard new products unless the brand can prove a commitment from a major chain retailer. Their justification?

“We don’t want to waste our time or resources unless we know there’s a guaranteed return.”

But this logic misses the point. If a brand already has chain authorization, they often already have:

- A preferred distributor

- National coverage plans

- An in-house sales force

- Retailer-specific logistics needs

So why would they hand over that opportunity to a local or regional distributor who sat on the sidelines?

💸 The Hidden Cost of Waiting: Lost Revenue

Distributors don’t track what they lose. But they should.

🔍 Let’s Look at a Hypothetical Case:

- Brand X is a new functional sparkling water with high gross margin and strong social media traction.

- Distributor A says: “Come back when you get a chain.”

- Distributor B takes a risk, picks it up, and helps build sales in independent stores, gyms, cafés, and niche markets.

Six months later, Brand X gets chain authorization in 3 regional grocery chains—but now they’ve already committed to Distributor B.

🧮 Estimated Missed Revenue:

Let’s say Brand X sells:

- 100 cases per store per month

- In 250 stores

- For $8 case cost

- With $2 gross profit per case to the distributor

That’s:

- 100 x 250 = 25,000 cases/month

- 25,000 x $2 = $50,000/month

- $600,000/year in gross profit LOST by Distributor A

Multiply that by 10 brands a year that follow this path. That’s a $6 million annual mistake. And that’s conservative.

📉 The Flawed Incentive System

Many distributors act more like logistics companies than brand builders. Their mindset is:

“We’ll deliver the product, but the manufacturer needs to sell it.”

This leads to a ridiculous dynamic where:

- Manufacturers hire sales reps

- Manufacturers do the retail pitching

- Manufacturers pay for promotions

- Manufacturers fund in-store merchandising

So what is the distributor’s job, exactly?

If all they’re doing is warehousing and dropping cases off, why do they deserve exclusive territory and margin?

This isn’t a rhetorical question—it’s one many brands are now asking out loud.

⚠️ Case Study: Celsius

Celsius is a textbook example of what can happen when distributors wait too long. For years, DSD distributors brushed off Celsius. It didn’t fit the mold. It wasn’t backed by a celebrity (yet), and it didn’t have chain mandates.

So Celsius built itself through:

- Amazon

- Fitness influencers

- Independent gyms and studios

- Social media

By the time distributors came knocking, Celsius was already working with national DSD systems—including PepsiCo, who saw the brand’s explosive growth and offered to muscle it into major chains. Local distributors were left with nothing.

Now Celsius is a multi-billion-dollar brand with over $1.3 billion in sales in 2023, and countless DSD distributors are sitting there thinking, “We could’ve had that.”

🥨 Case Study: LesserEvil Snacks – The Road Less Distributed

LesserEvil is one of the biggest success stories in the better-for-you snack category. The brand, known for its organic popcorn, Paleo puffs, and now broader snack line, didn’t have the easy route to mass-market distribution. Why?

Because UNFI and KeHE, the two dominant specialty distributors in natural and organic, didn’t jump on board in a meaningful way until the brand had already proven itself. In fact, LesserEvil spent years building its DTC channel, small health store partnerships, and investing in owned manufacturing—all before any major chain gave them authorization.

In a 2021 interview, CEO Charles Coristine spoke candidly about the challenges:

“Distributors want plug-and-play. They want velocity from day one. They’re not really designed to help a brand get there—they expect you to arrive already built.”

What happened next? Whole Foods finally took notice. Then Sprouts. Then Kroger. By the time UNFI and KeHE wanted to scale the brand across their networks, LesserEvil already had leverage—and a reputation.

Today, the brand’s annual revenue is estimated in the $50–75 million range, and growing fast. Like Celsius, distributors missed the chance to be early-stage partners, and instead became late-stage logistics vendors.

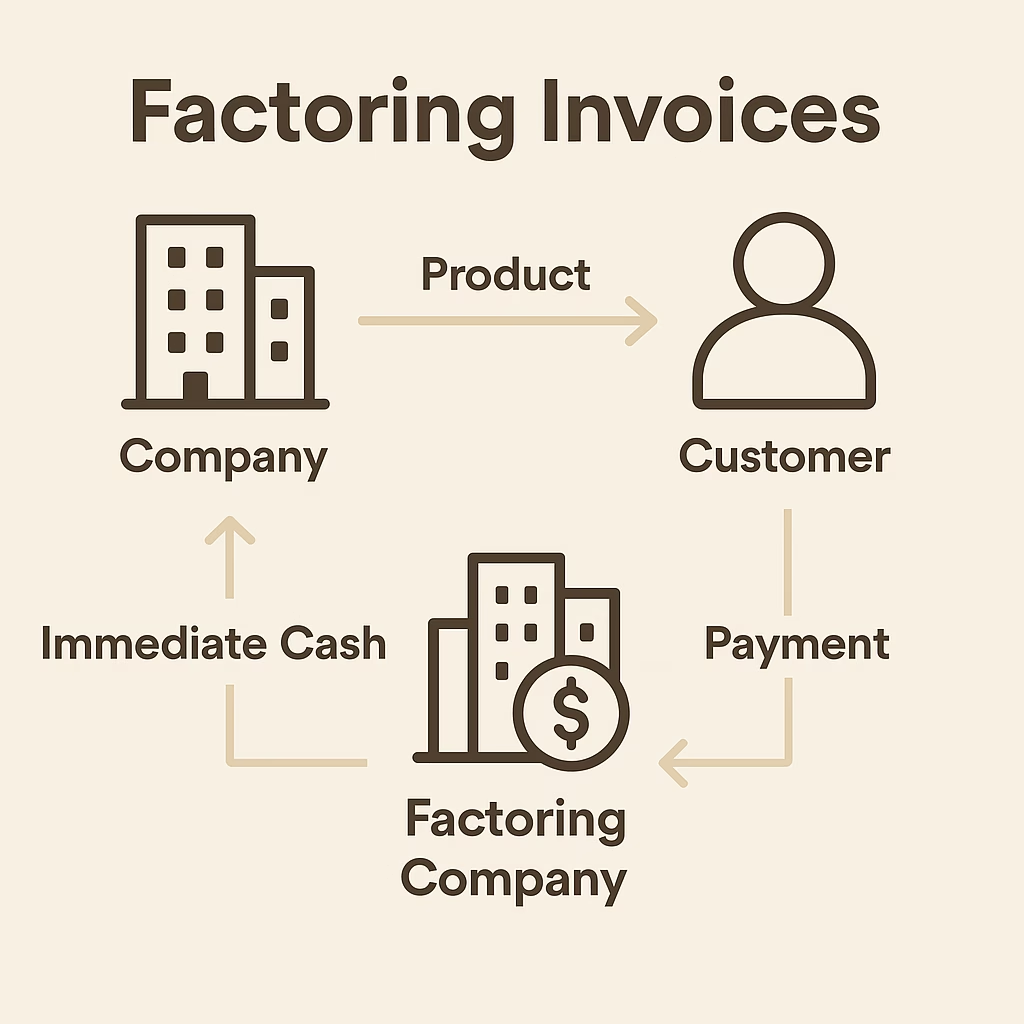

🛑 The UNFI and KeHE Bottleneck: A Necessary Evil… or Just Evil?

Let’s talk about the two biggest names in natural food and beverage distribution: UNFI and KeHE. To many emerging brands, getting into their system feels like a rite of passage. But here’s the reality:

It’s more like paying to enter a casino where the house always wins—and the dealer already knows you’re broke.

These companies control most of the distribution in natural grocery and independent health food chains. If you want to get into Whole Foods, Sprouts, Natural Grocers, or even many co-ops, they’re often your only option. But that monopoly comes at a massive cost.

🚨 The Pain Points, Unfiltered:

- ⏳ Onboarding Takes 6–9 Months

Just to be set up in their system, expect a timeline that can stretch close to a year. During this time, you’re paying brokers, attending trade shows, and funding marketing—without a single PO. - 🏷️ Massive Slotting & Listing Fees

Want to be listed in their system? Expect to shell out thousands of dollars per SKU just for the privilege. - 🧾 Chargebacks & Reductions That Can Bankrupt You

You won’t know what hit you. Suddenly you’re seeing deductions for:- Delivery issues (even when it was their mistake)Promotional spend you didn’t approveRetailer “marketing” feesFuel surchargesHoliday delivery delays

Some brands get hit with so many deductions that their checks are cut in half—or disappear entirely. - 💸 Sometimes, You End Up Owing Them

Let that sink in. Not only do you not make money—some new brands actually owe UNFI or KeHE money at the end of the month. And the kicker? They don’t send you a bill.

They just deduct it directly from what they were supposed to pay you. And in some cases, you’ll be asked to write them a check. - 🤯 No In-Store Selling or Merchandising Support

UNFI and KeHE do not have reps in stores checking your facings or replenishing inventory. That’s your problem. Which means:- Products sit in the backroom.

- Retailers think it’s out of stock.

- You get discontinued due to “poor performance.”

- 📉 Velocity Thresholds Are Brutal

If you don’t hit certain numbers fast, you’re pulled from the warehouse—regardless of your brand’s potential or promotional runway.

🎭 The Great Illusion of Success

The most dangerous thing about UNFI and KeHE is this:

They make you feel like you’ve “made it” when you’ve actually just signed up for the hardest part of your journey.

You think you’re on the shelf at Sprouts? Great. Now go sell it yourself, fund the marketing, deal with out-of-stocks, and hope you don’t get billed for a delivery that sat on a warm dock for two days.

🚚 So What Should Distributors Actually Be Doing?

Let’s get back to basics. A good DSD distributor provides:

✅ Store-level selling support (sales reps visiting stores)

✅ Merchandising (ensuring product is on shelves, not in the backroom)

✅ Promotion execution (endcaps, displays, cold box placement)

✅ Retailer relationship management

✅ Category insight and retail feedback

If you’re not offering this, you’re not a distributor. You’re a delivery service.

✅ Final Thought (with a Key Takeaway)

Distributors like UNFI and KeHE, and most distributors in general, aren’t set up to build brands. Yes, there are exceptions but most of them are logistics platforms with a sales deck, not growth partners. If your product already has momentum, retail commitments, and a sales team doing the heavy lifting—they’ll deliver the boxes.

But if you’re looking for a true partner to get you on shelf, stay on shelf, and build a business that lasts, you need more than a distributor.

You need a strategy. You need sales execution. You need a team that knows how to navigate the bottlenecks, negotiate the fees, and drive sell-through, not just sell-in.

🚀 Key Takeaway

That’s where Cascadia comes in.

At Cascadia Managing Brands, we’ve spent decades helping brands avoid the exact traps outlined above. We know which distributors to push, which to skip, and how to build demand that makes retailers ask for your product. We don’t just tell you how to do it—we do it with you.

If you’re serious about scaling your food or beverage brand—and tired of getting ghosted by distributors who only want guaranteed wins—talk to us.

We’ll help you stop chasing gatekeepers and start building real revenue